- +265 (0) 999 970 950 / 951

- mccci@mccci.com

Malawi Resource Endowment

Malawi is endowed with a wide range of mineral resources, some of which have been mined for decades, and some whose potential for beneficiation at medium to large-scale levels is recently being discovered. Some of the mineral resources with economic potential include uranium, phosphates (apatite), bauxite, kaolinitic, coal, kyanite, limestones, rare earths (including strontianite and monazite), graphite, sulphides (pyrite and pyrrhotite), titanium minerals, and vermiculite.

The full mineral potential of the country is not yet sufficiently known. Considerable basic geological work and ensuing exploration are required to respectively determine and confirm the potential. Much of the available geological information is either outdated or inadequate, while globally the technology and techniques currently used for exploration have advanced significantly. As a result, the known mineral occurrences, particularly for metallic minerals, will need to be re-examined using modern exploration techniques.

It is however expected that exploration activities together with an on-going Geological Mapping and Mineral Assessment Project (GEMMAP) will help collect data on the different types of minerals that exist in Malawi. Below is a table with some of the deposits, locations, and reserves.

Mining Activities

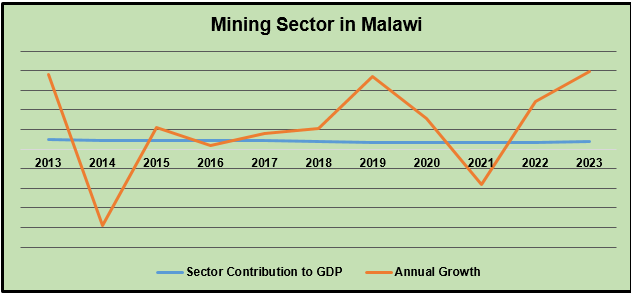

Currently, the mining sector contribute only 1 percent to Malawi’s GDP. Despite having a wide range of mineral endowments, commercial mining has only been restricted to few minerals including coal and cement limestone. However, it is Government’s conviction that if the mineral resources of Malawi are commercially mined, the contribution of mining to the GDP will increase at an average annual rate of 10 percent for the next 10 years.

In terms of annual growth, the sector is very volatile as it heavily depends on other sectors including the construction industry. Figure 1 below shows the contribution of the sector to GDP and its growth in the last decade

Coal Production

Coal is the most mined energy mineral in the country, a key driver of various industrial processes such as tobacco curing, cement manufacturing, brewing of alcoholic beverages, and food processing. The country has over 22 million tonnes of proven coal reserves, with the most viable coalfields being Livingstonia and Ngana in the northern region. The producing mines currently are Kasikizi, Kaziwiziwi, Mchenga, and Chombe coal mines.

Uranium Concentrates

The only existing mine is the Kayerekera Uranium Mine, commissioned in 2009 and placed under Care and Maintenance in 2012 due to low global prices of uranium, thus halting production until the present day. On the positive side, the mining rights and a few uranium exploration licenses in the area were acquired by Lotus Resources, which has been conducting technical work to facilitate the re-opening of the mine. The new owner has shown optimism that re-opening is imminent considering prevalent global economic trends. The feasibility study that was conducted in 2022 revealed that Kayerekera is ranked as one of the lowest capital-cost uranium projects globally.

Cement Limestone and Iron Ore

In the Cement Industry, Shayona Cement Corporation, Cement Products Limited (CPL), and Lafarge Cement (Malawi) Limited remain the only producers of cement in Malawi. However, only Shayona Cement Factory based at Chamama in Kasungu District, and Cement Products Factory in Njeleza, Mangochi District, are currently using locally mined limestone and iron ore to produce cement in Malawi.

Rock Aggregate Production

Quarrying is used to produce rock aggregate in the country. The sub-sector is vibrant owing to the presence of vast outcrops of granitic rocks and the high demand for rock aggregates from the civil construction sector. Quarries are classified into two groups: commercial quarries, which produce rock aggregate products for sale to various clients; and project quarries, which are operated by contractors to supply rock aggregate products for national civil construction projects in conjunction with the Ministry of Transport and Public Works. Both types of quarries pay royalty fees to the Ministry of Mining. Out of 29 active quarries in 2023, 18 were commercial quarries, whereas 11 were project quarries.

Structure of The Sector

Artisanal and Small-Scale Mining (ASM) activities in Malawi have grown considerably in recent years and are a source of livelihood for many families in rural areas. ASM has the potential to limit rural-urban migration and stimulate local processing and manufacturing industries. These encourage local entrepreneurship thereby creating employment and contributing to poverty reduction.

ASM sub-sector has been identified as a key area to encourage economic growth to help the poor, which is in line with the results of the recent Global Extractive Industries Review. Most artisanal and small-scale miners exploit small deposits in remote areas from where it is generally difficult to get their products to the market. ASM operations often operate illegally and receive little supervision or support from the local or central government authorities. Their operations are labour intensive, low paying, hazardous, and largely unregulated. ASM cause significant damage to public health and the environment by destroying the landscape and spreading pollutants. However, with adequate support, ASM can contribute to economic and sustainable development, particularly in rural areas.

Issue Affecting the Sector.

Promotion and Marketing: The mineral sector has not been adequately promoted and marketed; as a result, the resources remain largely unexploited. There is therefore need to aggressively promote the minerals sector in order to attract investment so that the sector can significantly contribute to economic growth. The development of the sector can be accelerated by Government initiatives such as attracting Foreign Direct Investment (FDI). Efforts by the Malawi Investment Promotion Agency (MIPA) and the Malawi Development Corporation (MDC) did not adequately help to promote and market the mineral sector because of the two institutions’ emphasis on other sectors.

Mining Development: Malawi is endowed with a lot of mineral resources, however, it has traditionally been considered as an agricultural country because of the policies that Government pursued since attaining independence in 1964. As a result, there was very minimal mineral development in the country. Consequently, there was no mining culture and little technical capacity developed. Additionally, there has been little interest by local companies to venture into mining projects and this has also been partly as a result of lack of support from financing institutions.

Infrastructure: Infrastructure is key to the growth of the mineral sector and Government is aware that the sector is unlikely to develop unless improvements are made to the existing infrastructure such as transport networks, telecommunication and electricity supply.

Training and Research & Development: Sustainable development of the mineral sector requires considerable capacity building, training, and significant scientific research and technological development. Mining is a skill-intensive industry, and the quality of the available human resources in Malawi constitutes an important key for the competitive growth of the mineral industry in the country. However, it is also recognized by the Government that because of development priorities, economic constraints and human constraints, the development of capacity and training will have to follow a phased approach. Technological innovation is also central to the competitiveness of the mining sector. In particular, it is noted that large-scale mining is technologically intensive, with high capital costs, and with competitiveness based on the ability to use new and more efficient technologies.

Value Addition: Mining in Malawi is primarily concerned with the production of mineral raw materials that are used elsewhere in downstream industries, thus achieving the addition of value in other places. While raw mineral commodity prices fluctuate widely, the prices of value-added products fetch higher prices. These prices tend to stabilize with each increasing stage of processing and fabrication.

Macro-economic Environment: Malawi has been experiencing macro-economic instability characterized by high interest rates and inflation. This has discouraged direct foreign investment. In order to encourage investment, a set of macro-economic challenges that are relevant to investors need to be addressed.

Mineral Royalty: The state’s ownership of mineral rights is non-negotiable, as is the state’s right to collect exploration fees during prospecting as well as mineral royalties and ground rent during mining. The mineral royalty rates in Malawi are high in relation to others in the region and are generally applied to gross sales value. This may be a disincentive for foreign investment and may be one of the reasons for low investment in the sector.

Mining Strategic Plan 2022-2027

Meanwhile, in order to resonate with the country’s industrialization drive at this early stage, the Ministry of Mining has developed a five-year Strategic Plan for the period, 2022-2027, accentuated by its passion and commitment to fulfil its vision, mission and mandate to the nation.

The aim of this Strategic Plan is, therefore, to promote growth and sustainable development of the mineral sector with a view to stimulating exports and contributing to import substitution. Obviously, the private sector, including major investors and artisanal and small-scale miners, will play a key role in fulfilling this initiative. This Strategic Plan provides a new operational framework with a clear mission, vision and strategic objective along with clear performance indicators. Furthermore, it has taken into account various challenges that have taken place at both micro and macro levels. The Strategic Plan, therefore, responds to a greater extent to some key challenges that the sector has been facing all along.

Vision: A nation that sustainably utilizes and manages the mineral and Petroleum resources for socioeconomic growth and development.

Mission: To coordinate, facilitate, and promote participation of all stakeholders in the sustainable development, utilization and management of mineral and Petroleum resources for socioeconomic growth and development.

Strategic Objectives

- To ensure the sustainable management and utilization of mineral and Petroleum resources;

- To monitor and assess geological hazards for proper planning and instituting possible mitigation measures;

To strengthen national, regional and international cooperation in mineral resources management and development; Ministry of Mining Strategic Plan 2022-2027.